So-called gig economy companies which rely on an independent workforce are facing the downside of this loose relationship during the COVID-19 outbreak as workers struggle due to the lack of protection and employee benefits.

Gig workers have become frontline responders as COVID-19 spreads around the world, transporting people who want or need to avoid public transportation or delivering groceries at home to individuals who are quarantined or self-isolated. When doing their job they are facing a higher risk of contagion and therefore a dilemma. Without sick pay they lose their income source if they get ill. If they continue working with an infection they would be putting their clients at risk.

Companies like Uber, Lyft, DoorDash, Instacart, Postmates and others have started to set out schemes (opens a new window) to compensate workers for time off and are trying to convince workers that they will be looked after if they fall sick and cannot do shifts.

The coronavirus is exposing a problem that has been growing worldwide in recent years, driven in part by a preference for non-traditional employment relationships over full-time jobs as people value the flexibility and freedom it gives them.

In the past decade, societies increasingly shifted away (opens a new window) from full time employment where job losses or transitions are the exception, to an environment where non-traditional contracts (self-employed, part-time, temp or freelancers) and occupational moves are frequent.

Currently, between 20 and 30 percent of the working-age population across the US and 15 European countries engage in independent work, according to a February 2020 McKinsey study2. This is the result of a combination of technological innovation, globalisation and the economic crisis of 2008.

Surprisingly, perhaps, about 70 percent of those engaging in independent work say they do so out of choice. Experts believe that the share of the population that works in a non-traditional employment scheme is set to expand further as opportunities to leverage digital platforms grow.

A potential new fault line

While most individuals engaging in independent work may appreciate the autonomy and flexibility it offers, this independence comes at a price, according to Zurich’s Perceptions on Protection report (opens a new window).

The dissemination of non-traditional work models combined with decreased social protection is shifting the responsibility for protection towards individuals and stress testing the traditional welfare models in respect to health, long-term care, pensions and income safety nets (disability, redundancy or premature death…).

Globally over 2/3 of self-employed or freelance workers do not have any form of contract and / or are either not yet able to generate the same amount of work (income), or prefer to work less than traditional employees. In addition, less than 50% of the total workforce consider themselves knowledgeable about how to protect themselves, creating further protection shortcomings to workers on non-traditional contracts since they are not included in the employee benefits schemes.

Preparing for the future talent war

Companies creating the most suitable solutions will attract the best talent.

Up to now, delivering protection via payroll has been the most effective channel to deliver employee protection, but this excludes the growing talent pool of workers in non-traditional relationships. The likely solution will be to provide protection and benefits directly linked to individuals and their dependants as opposed to a particular job or employment.

Companies will not only need to become more flexible in the way employment contracts are structured but also in their benefits offering, including customised products suited to the circumstances of each individual. This offering would comprise both permanent and temporary staff while ensuring not to lose the benefits of collectivised risks and shared responsibility to help their employees avoid protection fault lines.

Future protection should enable:

Income continuity during interruptions or breaks in earnings, jobs, and careers.

Longevity protection due to higher life expectancy, and

Labour mobility across jobs and jurisdictions

Empowering individuals so they understand the risks they face and developing consistent frameworks for them to protect against loss of income or as pension provision, retraining and collaboration will distinguish the companies of choice.

Technology to enable “flexicurity”

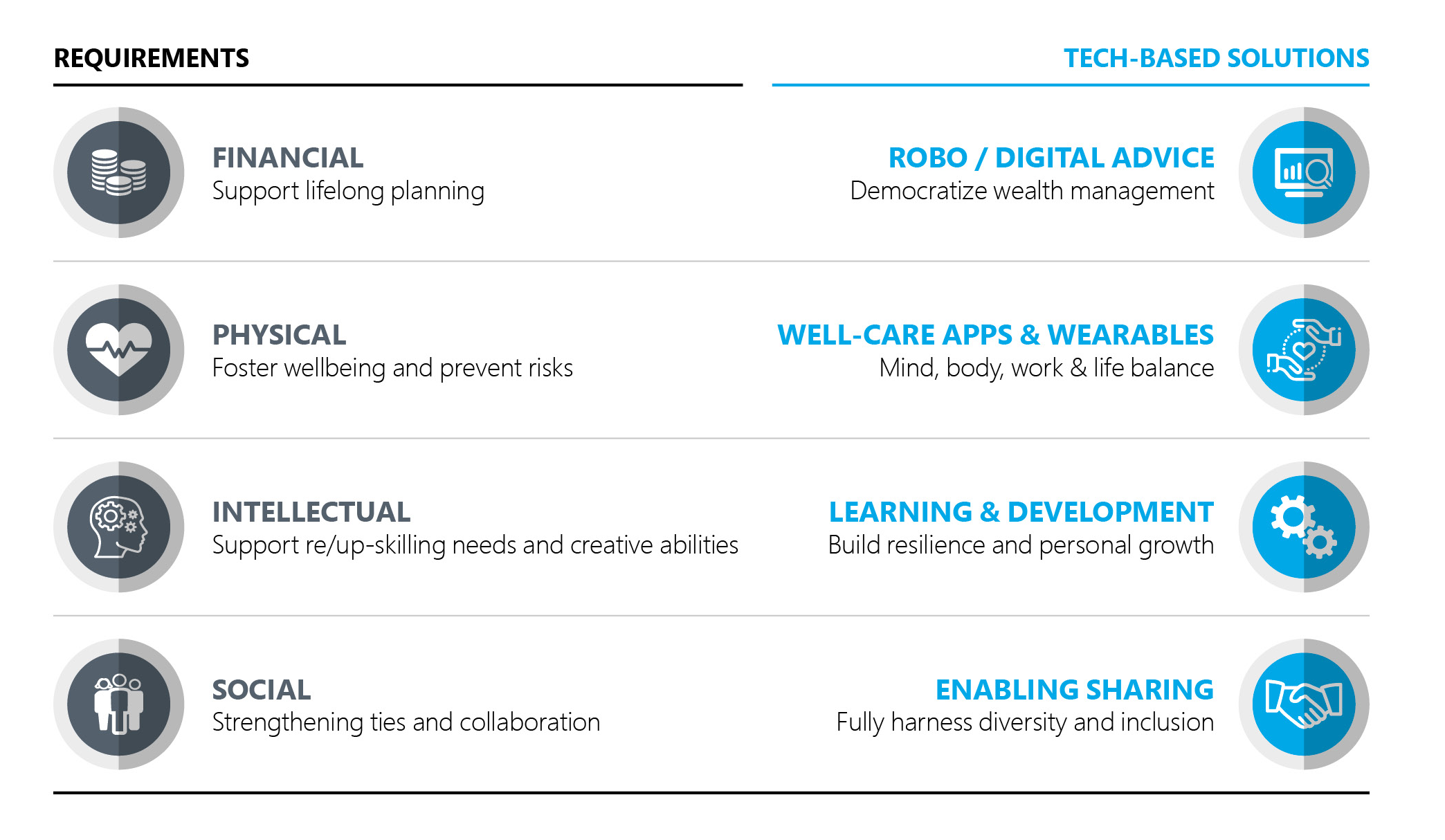

Technology is, at least partially, the cause and the solution to the problem. It will enable companies to strike the delicate balance between customisation and collectivisation of risks. Empowering individual choice while safeguarding privacy and risk sharing around the different dimensions of employee needs.

For further information, please contact:

Pablo Macián Clemente, Global Partnership Director Zurich

Tel: +41 44 625 48 13 | Email: pablo.macian@zurich.com (opens a new window)

Or:

Chris Rofe, Senior Vice President, Employee Benefits Lockton

Tel: + 44 (0)20 7933 2876 | Email: chris.rofe@uk.lockton.com (opens a new window)